Rumored Buzz on Opening Offshore Bank Account

Table of ContentsGetting The Opening Offshore Bank Account To WorkIndicators on Opening Offshore Bank Account You Need To KnowThe Ultimate Guide To Opening Offshore Bank AccountAbout Opening Offshore Bank AccountWhat Does Opening Offshore Bank Account Do?

This viewpoint did not age well in the wake of detractions at Goldman Sachs, Wells Fargo, Barclays, HSBC, and also others.The term offshore refers to a location beyond one's home country. The term is frequently used in the banking as well as monetary markets to define areas where regulations are various from the residence nation. Offshore places are normally island countries, where entities establish corporations, financial investments, and also down payments. Firms as well as individuals (usually those with a high total assets) may relocate offshore for more favorable problems, consisting of tax obligation avoidance, relaxed guidelines, or asset security.

The Best Guide To Opening Offshore Bank Account

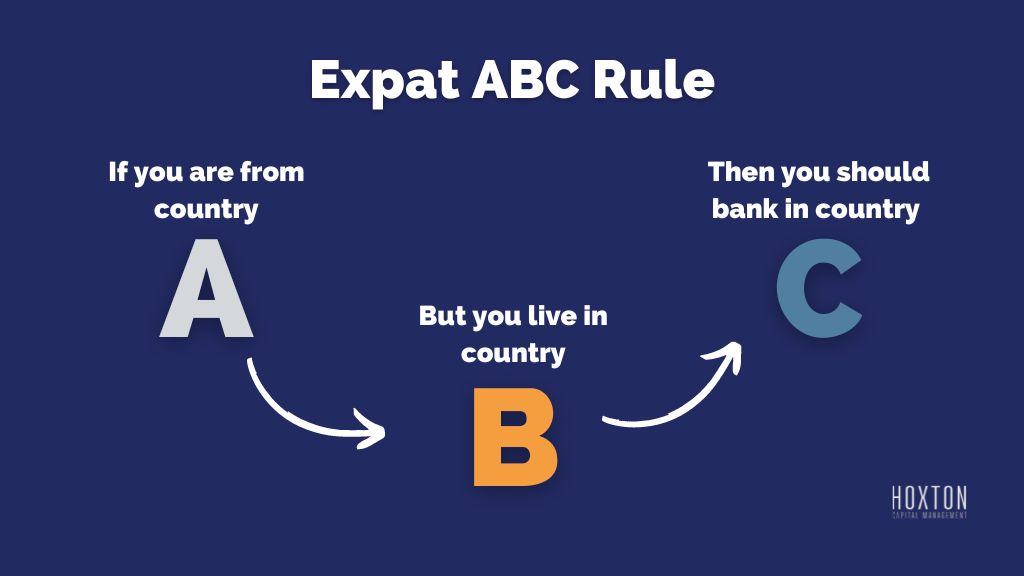

Offshore can refer to a selection of foreign-based entities, accounts, or other financial solutions. In order to qualify as offshore, the activity taking place needs to be based in a country besides the firm or financier's residence nation. While the house base for a person or company might be in one nation, the business task takes area in another.

Offshoring is completely legal since it gives entities with a wonderful bargain of personal privacy and also discretion. There is increased stress on these nations to report international holdings to international tax obligation authorities.

There are several kinds of offshoring: Service, investing, as well as banking. We've gone into some detail concerning just how these work below. Offshoring is typically referred to as outsourcing when it concerns business task. This is the act of establishing specific business features, such as manufacturing or phone call centers, in a country apart from where the firm is headquartered.

10 Easy Facts About Opening Offshore Bank Account Explained

This method is primarily made use of by high-net-worth capitalists, as operating offshore accounts can be particularly high.

This makes offshore spending past the means of a lot of capitalists. Offshore investors may likewise be inspected by regulatory authorities and tax authorities to make certain tax obligations are paid. Offshore financial involves securing assets in monetary establishments in international nations, which might be limited by the legislations of the client's residence nationmuch like overseas investing. Holding accounts overseas topics you to even check out this site more analysis. As pointed out above, even though some jurisdictions give full privacy to account owners, an enhancing number of countries are becoming more clear with tax authorities.

How Opening Offshore Bank Account can Save You Time, Stress, and Money.

You may earn money in the local money and are typically subject to regional labor laws - opening offshore bank account. You are thought about to see page be functioning offshore if your firm opens up a workplace in an additional nation and also relocates you to that location. Onshore suggests that company task, whether that's running a company or holding properties and investments, occurs in your house nation.

Offshore accounts are flawlessly lawful, as long as they are not utilized for immoral functions. Maintain in mind, though, that hiding your overseas assets is illegal.

Songsak rohprasit/Moment/Getty Images Offshore financial is the technique of keeping money in a checking account located in a various country than the account holder's home nation. There are many reasons that individuals pick to do this, consisting of the possibility for tax obligation advantages, asset protection, comfort, security, personal privacy, and greater rates of interest.

Some Of Opening Offshore Bank Account

Offshore financial institution accounts are financial institution accounts located in a country various other than the account owner's residence country. While overseas financial supplies some tax advantages, these accounts are not a valid method to hide cash from tax obligation authorities.

: Depending on the country where you live and the country where the bank is situated, your overseas content account could be tax-free or at the very least exhausted at a reduced rate.: An offshore account can be utilized to shield your assets in situation you're taken legal action against or your service fails.: You'll have easy accessibility to your account.